DeFi Strategies: Lend2Earn

"The credit system is the lifeblood of the economy" – Alan Greenspan

Hi everyone!

This is the first article on DeFi Strategies!

DeFi is a financial system without intermediaries. There’s no need for banks or other players — just you, smart contracts, and your assets. Everything works on the blockchain, and you have full control over your funds.

But have you ever wondered how to get the most out of it? For example, holding Bitcoin brings profit only when its price grows. But with DeFi strategies, you can not only wait for growth — you can actively increase your yield by providing liquidity and using blockchain opportunities.

DeFi Yield Strategies are not just ways to store assets. There are active ways to work with them: creating liquidity, and maximizing yield, even when the market is not always growing.

My goal is to make DeFi strategies understandable and accessible to everyone. In this article, I will show step-by-step examples that will help you understand how it works and explain how to increase your profit in DeFi.

This article will be divided into two parts: the first part is the explanation, and the second part will cover the potential yield.

This article is for educational purposes only. Everything presented here is general information about DeFi strategies and is not financial advice (Non Advice). DYOR (Do Your Own Research) — always conduct your own research before making decisions. Yield may vary depending on market conditions and other factors.

Let’s consider a strategy: yield through the USDC/cbBTC liquidity pool on @aerodrome in the Base network.

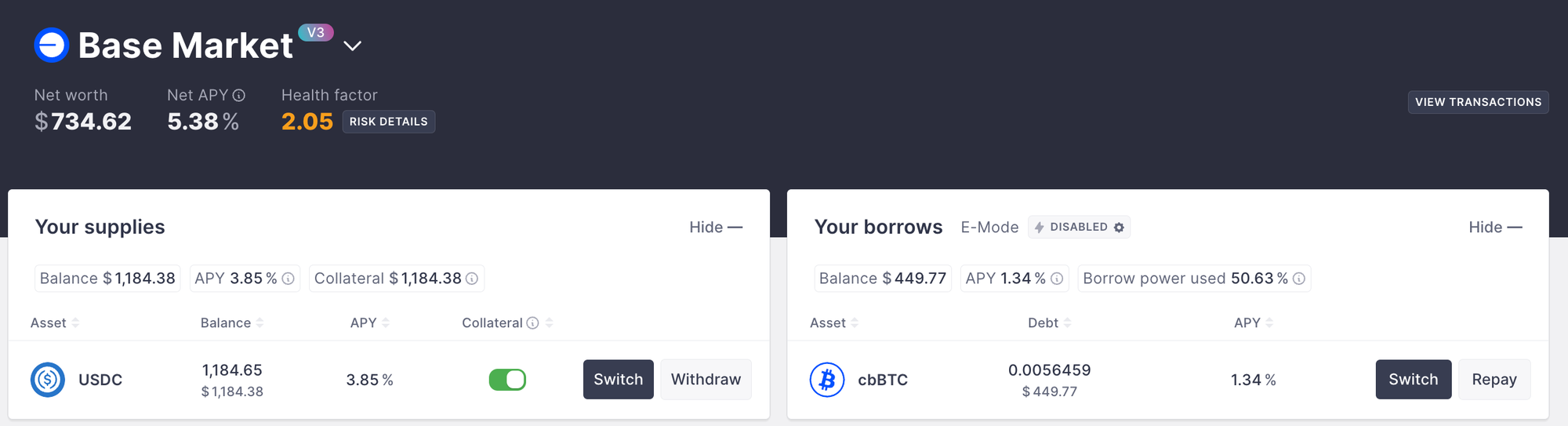

Step 1: First, you need to deposit USDC into the AAVE protocol on the Base network.

Step 2: Next, borrow the cbBTC asset. In my example, the loan interest rate is 1.34%, and the overall NET APY is 5.38%. This means I am earning yield on my position, and the risk factor is 2.05.

What does this mean?

A risk factor of 2.05 means my position is secure, but it’s always important to monitor the Health Factor (position health index), as the asset prices may fluctuate.

Important:

Keep an eye on market changes and check your Health Factors regularly. This will help avoid unexpected risks if the value of assets begins to fluctuate.

Step 3:

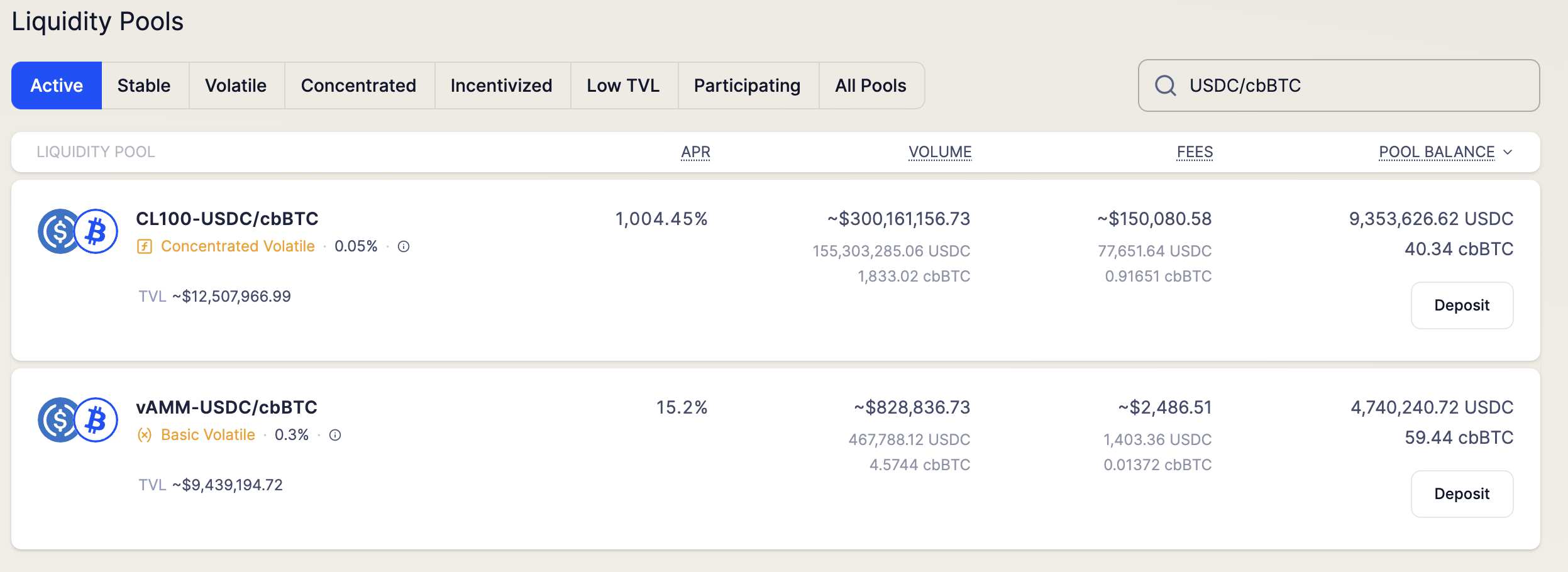

Now, go to the @aerodrome protocol and choose the USDC/cbBTC pool. In the interface, there are two types of pools: concentrated and basic.

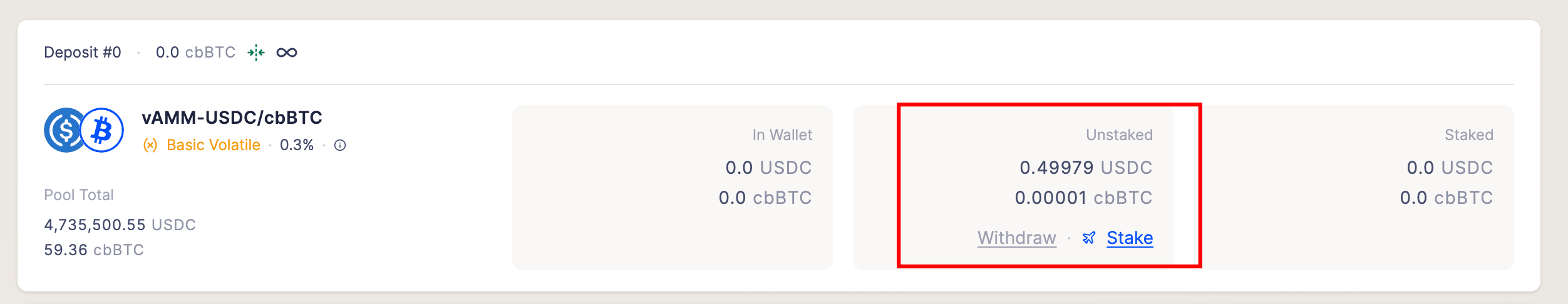

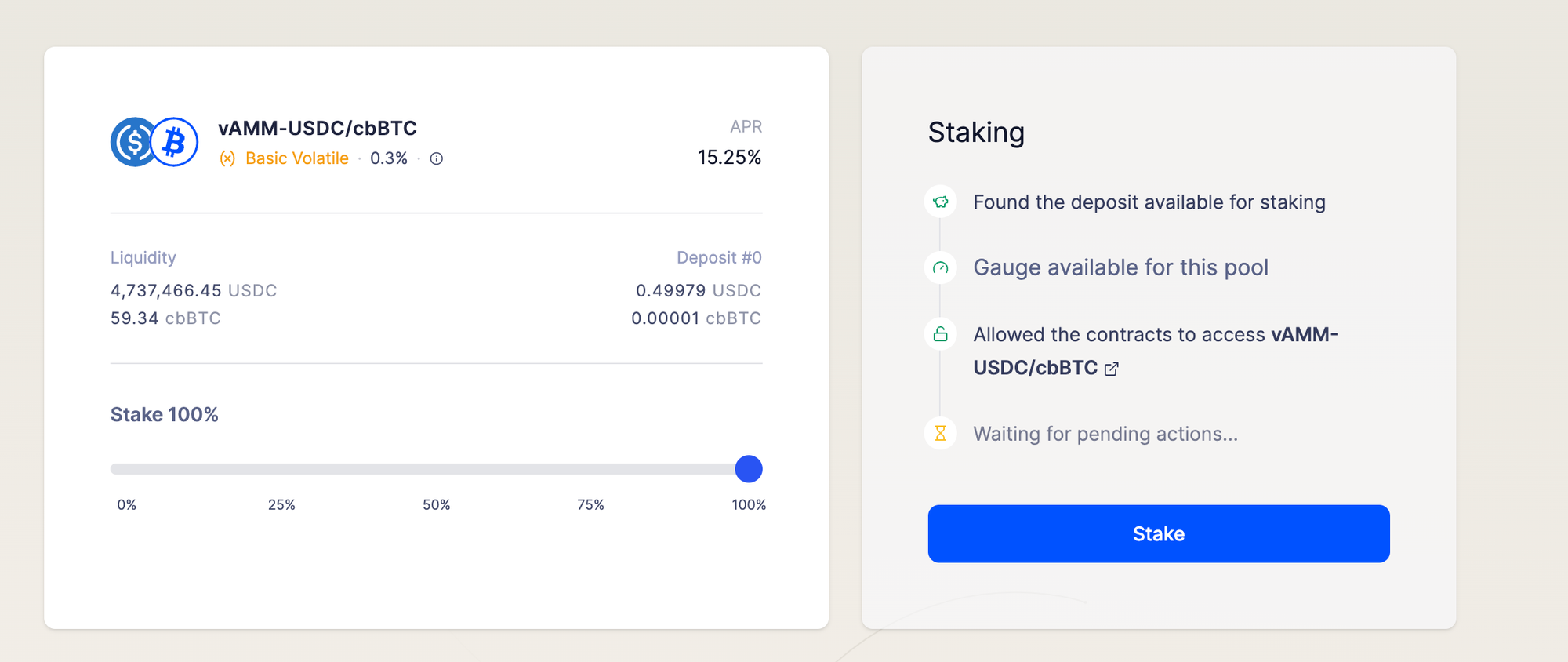

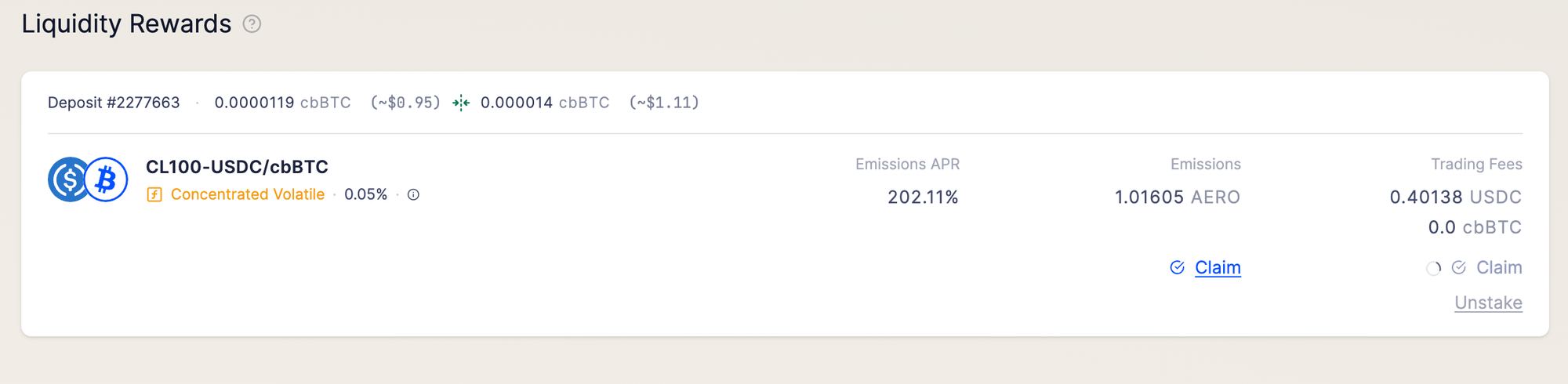

After depositing your assets (you will need to deposit two assets — USDC and cbBTC) into the pool, you must stake them to start receiving rewards on the @aerodrome platform.

Now, you will receive rewards in the form of $AERO tokens and also earn a commission from the transactions that occur in the pool.

At this point, we have several options:

- Holding: Keep the $AERO token.

- Selling: Sell the $AERO token at the market price.

- Staking: Stake $AERO to earn an additional 10%.

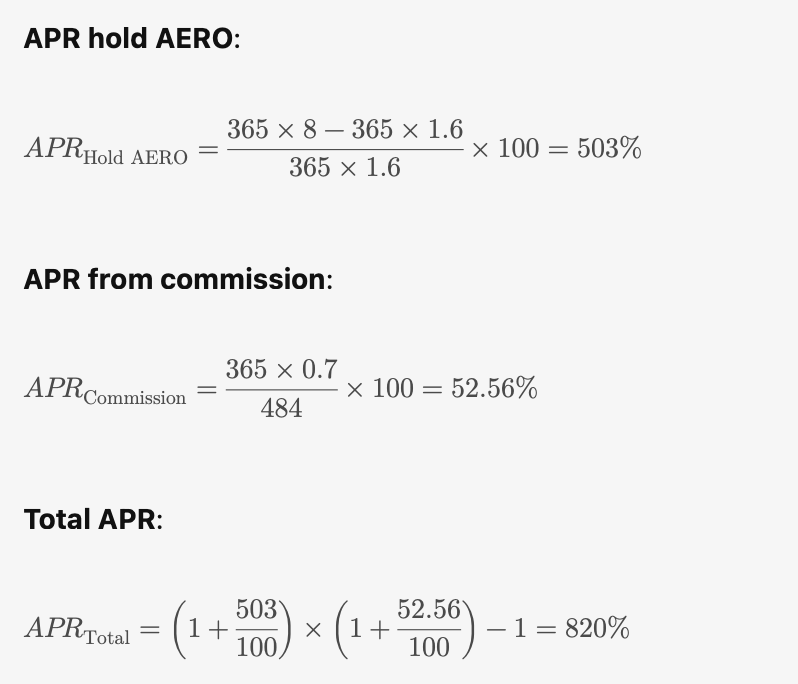

Holding

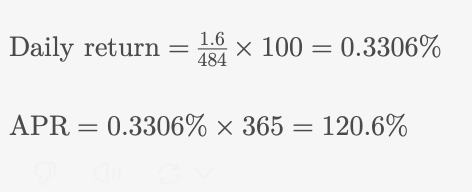

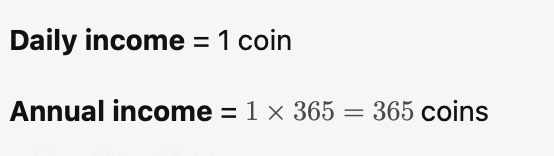

Our daily yield is $1.6 (1 $AERO/d). In this case, at the current rate, we earn 1 token per day, which gives us 365 tokens for the year. If the token price increases by 5 times from the current value, we get:

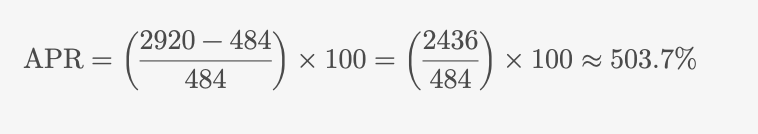

365 × $8 = $2920, which corresponds to an APR of 503%.

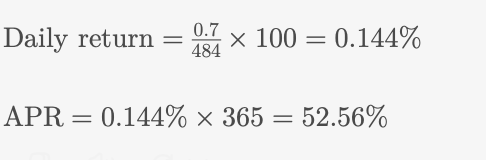

Transaction Commission

Additionally, we receive about $0.7 per day from transaction commissions, which adds another 52.56% APR.

Thus, the combined yield could reach up to 820% APR.

Of course, these numbers may vary, but my goal is to show you an example based on current data.

Why not just take cbBTC and put it in the pool?

Good question. The essence of this strategy is to preserve your USDC while earning yield through lending. When the price of BTC rises, the value of your pool increases. But even if the price falls, you’re still in profit because your debt remains lower than your yield.

If the yield starts decreasing, you can withdraw your funds from the pool, pay off the loan, and keep the difference. This gives you flexibility and allows you to minimize risks, as your debt is always proportional to the assets in the pool.

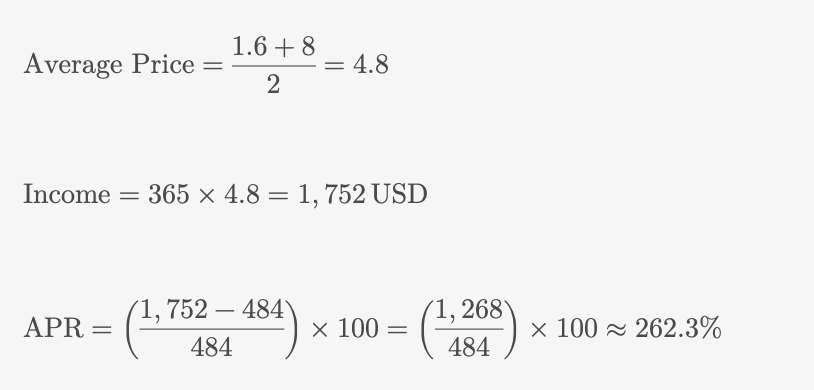

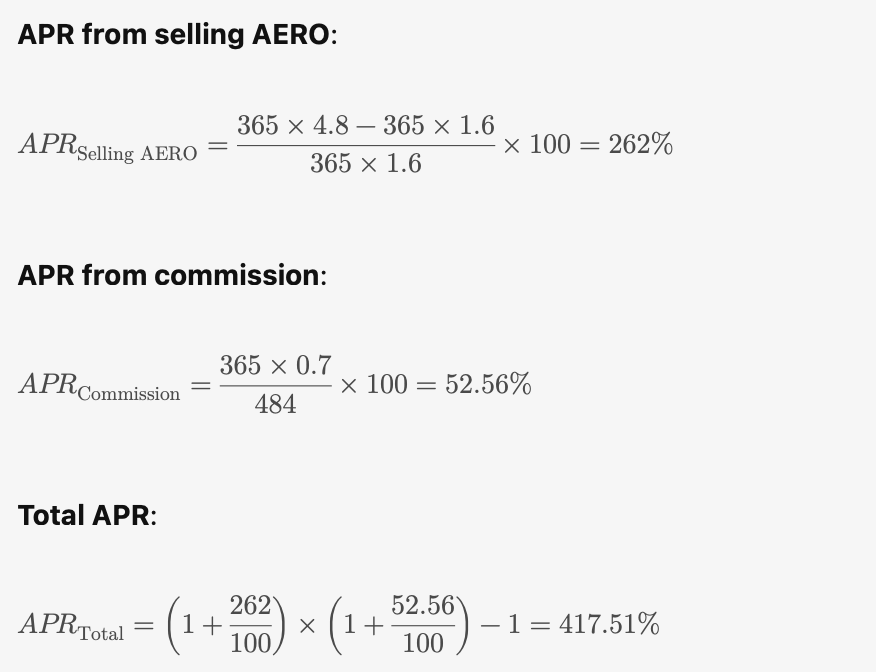

Selling

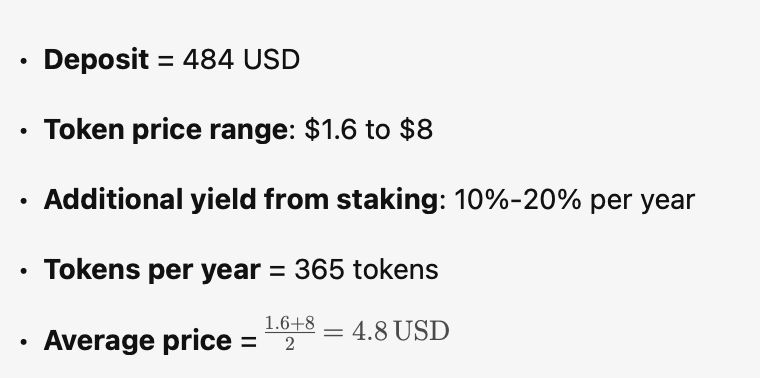

Let’s assume we decide to sell the $AERO token daily. If the price increases from $1.6 to $8 over the year, the average price will be $4.8 per token. Over the course of the year, we’ll receive 365 tokens (1 token per day). Therefore, the total income will be:

365 × $4.8 = $1752, which corresponds to an APR of 262%.

Adding the commission yield of 52.66%, the total APR becomes 262% + 52.66% = 314.66%.

Thus, the total annual return will be 417%.

Staking

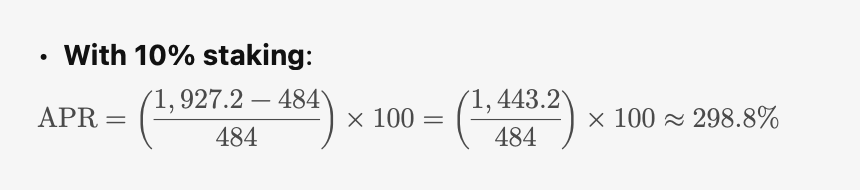

Let’s take the same scenario.

Let’s take the same scenario. Suppose we get an APR of 10% for staking. This gives us a return of almost 300% for the year.

If we include the yield from commissions, the total return will be 339%.

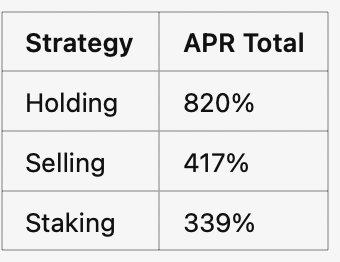

Results

If we model our scenario, the most profitable strategy is holding, followed by selling and then staking.

It’s important to note that the first two scenarios complement each other, creating a compound interest effect.

Are there any risks?

Yes, there are several risks to consider:

1. Impermanent loss: This occurs due to price changes in assets within a liquidity pool. The greater the price change, the higher the potential loss, but if prices normalize, the loss can disappear.

2. Increased borrowing interest rate: An increase in interest rates within protocols can reduce profitability and lead to liquidation of positions. Monitor the health factor to stay within a safe zone.

3. Stablecoin depeg: If a stablecoin loses its peg to the dollar or another fiat currency, it may result in losses and position liquidation.

4. Smart contract hack risk: Vulnerabilities in smart contract code can be exploited by hackers. It’s important to interact only with trusted protocols and consider asset insurance.

5. Out-of-range risk (for concentrated pools): When an asset’s price moves outside the range in which liquidity was provided, you stop receiving fees, which reduces your profitability.

Conclusions

This strategy can be effective in active markets where transaction volumes are high. However, it is not passive, and you’ll need to constantly monitor and assess the risks.

Important reminder:

This article is for educational purposes only. The author does not provide financial advice. Always do your own research (DYOR) before making any investment decisions.

Please click on ❤️ if you liked this post and subscribe if you loved it!